In International Shipping News 01/09/2017

A number of European-sourced gasoline cargoes on the water, which were initially bound for destinations in West Africa and within Europe, have now changed destination to the U.S. in the wake of Hurricane Harvey. So far, Genscape has seen that around 111,000 metric tons (MT) of European gasoline diverted to the U.S.

Product tanker ‘Stenaweco Venture,’ which left Finland’s Porvoo refinery on August 2, changed her destination Thursday, August 31, from Lome, Togo, to Cape Canaveral, Florida, with a new ETA of September 9. Similarly, the ‘Elandra Oak,’ which left Milford Haven, UK, on August 29, changed her destination from Lome to Port Everglades, with a new ETA of September 10. Both are carrying 37 to 38 kilo metric tons (KMT) cargo lots of gasoline.

The ‘Elka Nikolas,’ which left the Lithuanian port of Klaipeda on August 26 and declared ARA as her destination, is now bound for New York, with an ETA of September 10, also carrying around 37 KMT of gasoline.

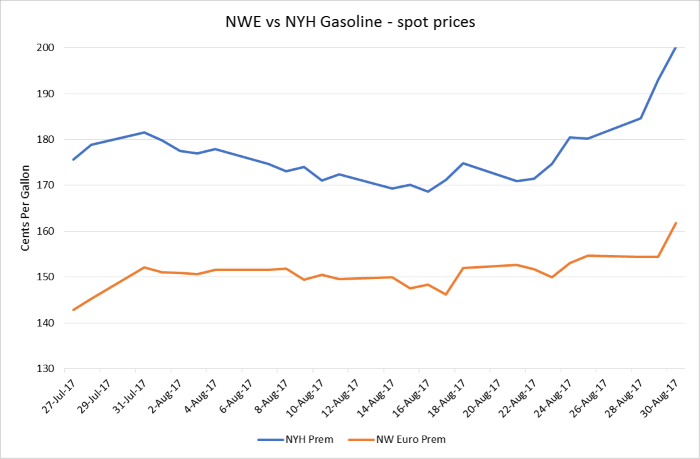

Freight rates for chartering product tankers to move gasoline from Europe to North America have also spiked sharply since the start of the week. As gasoline prices in the U.S. shot up a total of 20 cents per gallon from Friday, August 25, to Wednesday, August 30, there has been increasing interest to move petroleum products trans-Atlantic from Europe. This sudden doubling in freight costs broke a long recent spell of comparatively cheap trans-Atlantic freight rates.

Baltic Exchange TC2_37 freight rates from May 30 to August 29, 2017

Trans-Atlantic clean freight rates had previously been holding steady in a low range of around Worldscale (WS) 105-115 throughout most of August prior to the Hurricane Harvey, which has caused major disruption to refining operations in the U.S. Gulf, home to around half of the country’s total refining capacity. U.S. gasoline prices have risen sharply as a result, amid reports of disruption to the Colonial pipeline system, which moves products from the U.S. Gulf to the Northeast.

Some notably strong tanker fixtures already concluded this week include Statoil fixing the Green Planet to move around 37,000 MT of gasoline to the U.S. East Coast from its refinery in Mongstad, Norway, at WS 215, and Repsol, which fixed the Challenge Pearl at the same rate out of Northern Spain. Both loaded around September 5 and 10 laycan dates.

Many of new shipments are thought to be on subjects, i.e. provisionally fixed, and will have a range of discharge destination options throughout both North and South America. Port-specific destinations are generally declared on departure, but these can, and often do, change en route.

To date, some 918,000 KMT of gasoline has been chartered to move trans-Atlantic out of Europe for loading during the two weeks ending September 1 and September 8. Around 185,000 KMT is currently loading in European ports (as of August 30) and is expected to go Trans-Atlantic (based on fixture information). Another 310,845 MT of gasoline has already left Europe to go trans-Atlantic this week to destinations including New York and Tuxpan.

For comparison, recent weekly totals for trans-Atlantic gasoline exports to North and South America have recently been in a range broadly to either side of the 600 KMT mark, although did drop as low as 468 KMT in July.

Source: Genscape