In International Shipping News 24/03/2017

The board of directors (“the Board”) of COSCO SHIPPING International (Hong Kong) Limited (“COSCO SHIPPING International” or the “Company”, stock code: 00517.HK) today announced the audited consolidated results of the Company and its subsidiaries (collectively the “Group”) for the year ended 31st December 2016.

In 2016, world economy has experienced deep adjustment, while international trade growth remained subdued. The international shipping market supply and demand remained unbalanced, while dry bulk shipping index and container freight rate index had hit a record low last year. Facing such severe business environment, COSCO SHIPPING International insisted on the working principles of “securing steady growth, ensuring profitability, and enhancing service quality and efficiency”, and coped with the market changes proactively by improving service awareness, seeking new profit drivers and strengthening cost control, so as to maximise the profit.

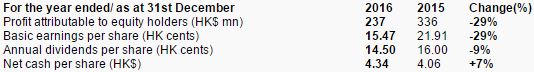

During the year, profit attributable to equity holders of the Company decreased by 29% YOY to HK$237 million. Basic earnings per share was 15.47 HK cents. The Board proposed a final dividend of 5.5 HK cents per share (2015: 9 HK cents). Together with the interim dividend of 4 HK cents per share, the total dividends are 9.5 HK cents per share, representing a dividend payout ratio of 61.4% (2015: 73.0%). In the meantime, to celebrate the 20th anniversary of COSCO SHIPPING International’s being a listed subsidiary of COSCO SHIPPING (Hong Kong) Co., Limited, the Board proposed the payment of a special dividend of 5HK cents per share. The final dividends for 2016 amounted to 14.5 HK cents per share.

As at the end of 31st December 2016, COSCO SHIPPING International had net cash of HK$6.7 billion, or HK$4.34 per share, which will provide strong capital support for major acquisitions and expansion of existing businesses in future.

Looking ahead, the global economic growth in 2017 is expected to be faster than that in 2016, which will provide a stronger support for the shipping demand. Although the overall imbalance between the supply and demand sides in the shipping sector still exists, it is expected to be relieved to a certain extent. The shipping market is on the rise and will become more rational. The structural recovery of the industry will further enhance market confidence. The further implementation of China’s “Go Global” strategy and “One Belt, One Road” initiative will present enormous opportunities for Chinese shipping enterprises to develop new markets.

COSCO SHIPPING International remains committed to the strategic direction of “Shipping Services Industrial Cluster”, in accordance to the overall strategic plan of COSCO SHIPPING, and strived to achieve intensive marketing and centralised procurement, as well as to gather talents. On the one hand, the Company will run existing businesses with a reforming and innovative mindset, adapt to the changes and timely adjust strategies in response to the market trend, as well as seek development opportunities. On the other hand, the Company will actively prepare to expand the asset size by putting considerable effort on the search of potential acquisition targets and development plan. The Company will capitalise on its listed platform for acquisition and corporate action, to achieve strategic upgrade and transformation and to become a world class and leading shipping services company in China. The Company will develop the “shipping services industrial cluster” which can offer strong supporting services for shipping with independent profit drivers, and to maximise the returns to the shareholders.

Financial Summary