In Dry Bulk Market,International Shipping News 27/04/2017

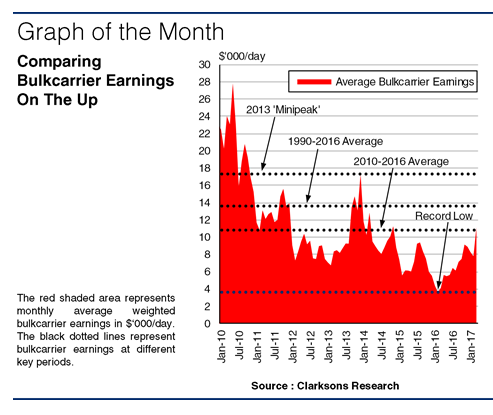

In March 2016, Commodity Countdown assessed the dry bulk market at rock bottom, as average bulker earnings hit record lows. In the thirteen months since, improved demand trends and slow fleet growth have driven a firm rise in average bulker earnings. However, while the bulker earnings environment has clearly improved in recent months, how do current levels compare historically?

Hitting Rock Bottom

By 1H 2016, the build-up of oversupply over a number of years had exerted significant pressure on bulker market conditions. Average bulkcarrier earnings fell to a record low of $3,636/day in February 2016, 73% below average bulkcarrier earnings in 1990-2016 and below typical operating cost levels. While market conditions improved tentatively in the months following February 2016, earnings in January to June 2016 still only averaged a historically depressed $4,807/day.

A Notable Climb

Bulkcarrier earnings then went on to record a distinct rise in 2H 2016 and early 2017. This was partly driven by Chinese seaborne dry bulk imports, which rose 6% y-o-y in 2H 2016 towards a record 1.6 billion tonnes in the full year, reflecting the country’s recovering steel output and the impact of Beijing’s domestic mining policies. On the supply side, strong demolition in 1H 2016 and continued delivery deferrals helped to stem the pace of bulker fleet growth to a sixteen year low of 2.2% in the full year. Overall, the improving fundamentals in the bulker sector were sufficient to see average earnings rise to $11,133/day in March 2017.

Overshadowed By Past Peaks

So, how does this compare to average bulkcarrier earnings in recent years? A quick glance at the graph might suggest that earnings in the sector remain relatively subdued compared to recent heights, even when excluding the boom years of 2004-08 when earnings reached a historical high of $65,173/day in May 2008. Indeed, bulkcarrier earnings in March 2017 were still 36% below the ‘minipeak’ of $17,314/day recorded in October 2013.

Standing Up To The Average

However, there is also a more positive context. Bulkcarrier earnings have risen notably, and with the market gaining momentum in recent months, average earnings in March reached a two year high. More tellingly, since having hit rock bottom, bulkcarrier earnings in March 2017 were already 75% of the way back towards the long term historical average of $13,576/day set between 1990 and 2016. Moreover, average bulker earnings in March actually exceeded the $10,765/day average for the post financial downturn period of 2010 to 2016.

So, bulker earnings have picked up since hitting rock bottom in February 2016, in line with improved fundamentals. Although bulker earnings remain far from robust and below recent peaks, they have recently returned to levels closer to longer term historical averages. Overall, while the recent improvement in the bulkcarrier market will no doubt have been welcomed by many owners, there are still a variety of contexts in which market performance can be viewed.

Source: Clarkson Research Services Limited