In Dry Bulk Market,Hellenic Shipping News 23/06/2017

Demand for dry bulk commodities from emerging economies could be set for a rebound. In its latest weekly report, shipbroker Allied Shipbroking noted that “during the past weeks, we have seen many organizations and think tanks show a more optimistic face with regards to the world economy. The World Bank, IMF and OECD have all made upward revisions to their world GDP forecast figures for 2017, while also showing better figures for 2018 as well. The consensus is that the outlook for global economy has been getting better during the first half of 2017, though most don’t hesitate to point out that it is still not good enough”, the shipbroker noted.

According to Mr. George Lazaridis, Head of Market Research & Asset Valuations with Allied Shipbroking, “the big improvement has been with regards to the perceived prospects of emerging markets, which are in their majority expected to reboot their growth momentum and show better figures then what we were seeing a year back. One of the promising of these is China, with the IMF increasing its GDP growth estimate from 6.6% to 6.7% for 2017, though still holding for a softening down to 6.4% between 2018-2020, which is in line with the government figures. India has also been one of the main, highly promising markets, these past years and from what it seems, its high prospects are not set to let anyone down anytime soon. Projected growth figures for 2017 for India are now set to reach 7.3%, while expectations are for this to propel up to 7.7% in 2018, maintaining as such its position as one of the world’s fastest growing economies”.

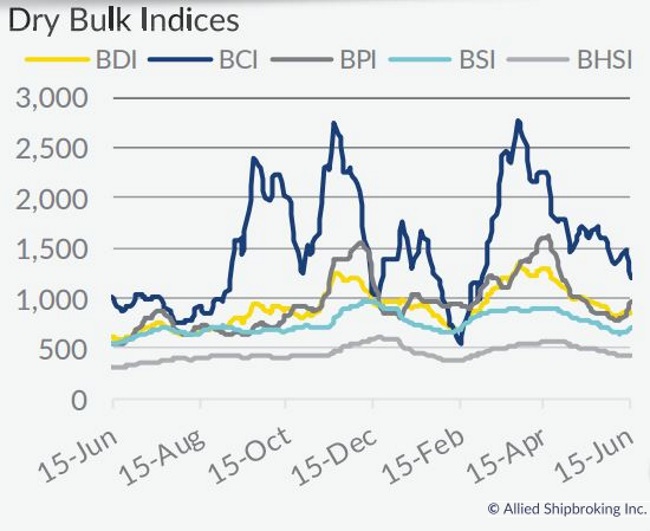

He went on to note that “during the midst of all this improved expectations, we have seen a small glimpse of light come out of the dry bulk freight market. The majority of routes for the Panamax, Supramax and Handysize segments showed a small revival. Though as things stand now it doesn’t seem to be anything remarkable just yet, though given the overall trend that had been noted since the end of March, it has played a pivotal role in helping calm down nerves amongst owners. We had started to note jitters amongst many who had started to feel as if some of the excess optimism that was being noted during the end of March was being based on false hopes. In truth, many were too haste to “call it”, before the market had even started to get a proper foothold”, said Lazaridis.

Allied’s analyst added that “in large part the past is mainly to blame. The main view being expressed is of a recovery and boom akin to what we witnessed back in 2002-2003. The reality is in fact more sober. At these low global economic growth levels, it is next to impossible to drive a rate frenzy like anything we had seen back in the early 2000’s. We must come to terms that the path to recovery will be a slow one and will require a considerable amount of effort so as not to choke the market improvement in its tracks just like we have seen countless times during the past 7 or so years”.

Allied added that “at the same time, it is important to note that although many of the more developed economies have been also seeing upward revised figures regarding their economic growth for this year, they are still at relatively low levels and still plagued with a considerable amount of instability. Even though it is emerging countries that primarily drive the raw commodities trade, without the boost of large consumption of end products from the wealthier consumers in more developed economies, the trade chain remains incomplete. You need developed countries to take up the role as a multiplier on global trade, turbo boosting demand as well as economic growth in export oriented economies as well as major commodity exporters. Countries such as China have been covering the gap left behind by the U.S. and Europe over the past couple of years, however without these major economies stepping up to the plate it will be difficult to see global economic growth figures reach double digits any time soon”, he concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide