In Dry Bulk Market,International Shipping News 10/07/2017

Supramax Index Weekly

Support –7,412 6,934, 6,680, 5,769

Resistance – 8,950, 9,794, 10,034

The 200 period moving average at USD 8,271 is currently acting as a resistance within the technical range for the Supramax index.

Failure to trade close above last week’s high at USD 8,282 would suggest market weakness targeting USD 7,412 and potentially USD 6,934. Likewise a close above the USD 8,282 high would suggest market continuation to the USD 8,950 low.

Momentum remains oversold on the weekly chart, however there is still room for some downside movement at this point, though it seem we could stay within the range for a few more weeks yet.

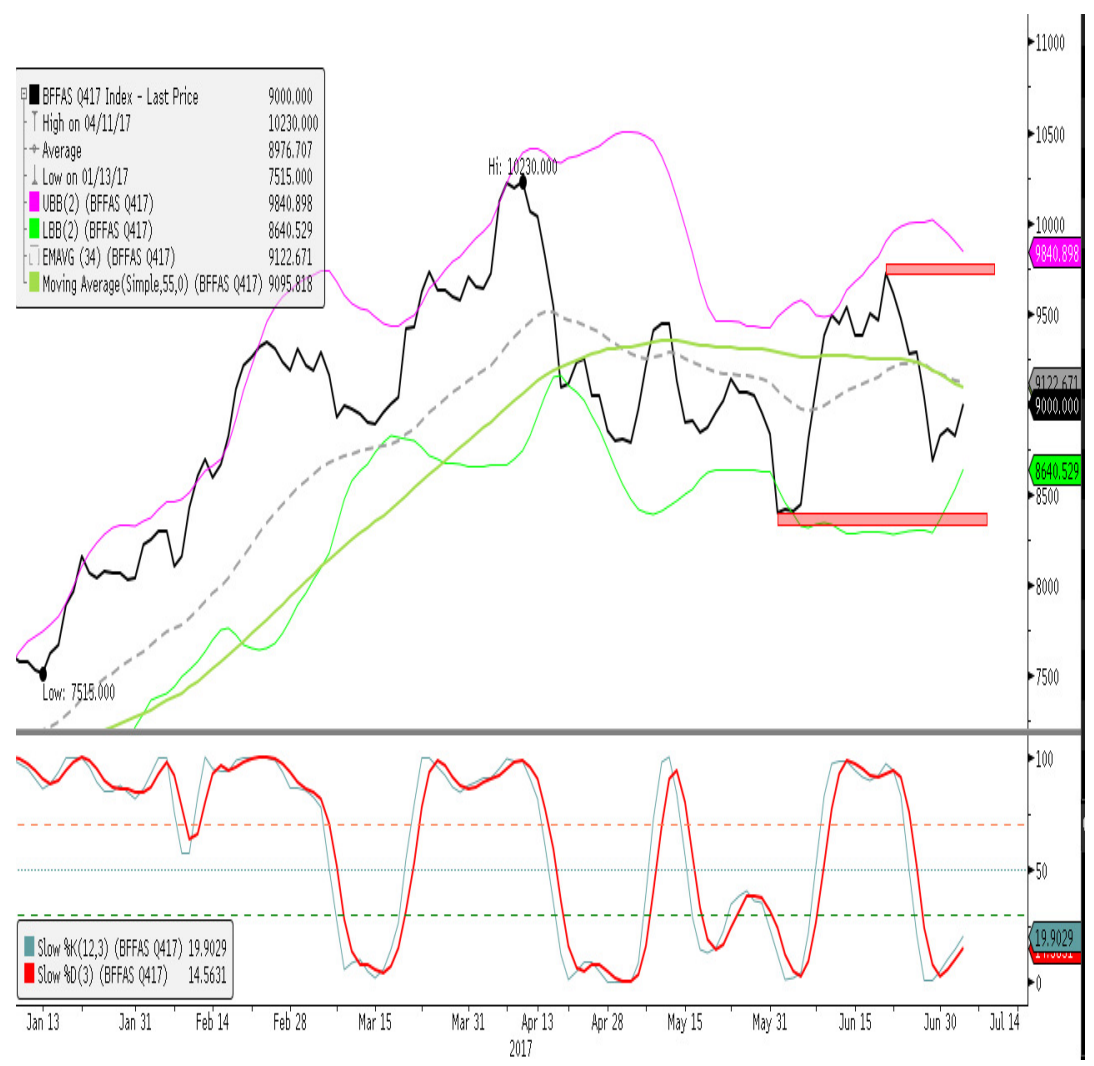

Supramax Q4 17 Daily

Support – 8,686, 8,395, 8,030

Resistance- 9,375, 9,720, 10,230

The Q4 futures are currently the middle of a range between USD 9,720 and USD 8,395. Technically a dangerous area to enter fresh positions. Downside moves that fail to close below the USD 8,395 support should attract technical buyers targeting the range resistance at USD 9,720.

However a close below the support level would suggest downside continuation. Upside moves that fail at the USD 9,720 resistance would confirm the range to technical sellers, targeting support at USD 8,395. Likewise a close above the resistance would suggest upside continuation.

The stochastic is in oversold territory but the price is in the middle of the range, indicating better entry levels could be achieved near the support and resistance highlighted.

Supramax Cal 18 Daily

Support –, 8,420, 8,070, 7,800

Resistance – 8,940, 9150, 9,610

Price action remains below the 50 period MA (USD 8,596) on an oversold stochastic. The recent higher low has resulted in bullish price action, with buyers looking for an upside target of USD 8,940.

A close above the resistance would imply upside continuation in the form of a higher low and higher high. Upside moves that fail to close above USD 8,940 would be considered as bearish for the Cal 18. A close below USD 8,420 would confirm market weakness, targeting USD 8,070.

The higher low would suggest upside continuation, however the stochastic remains in oversold territory, which would indicate price momentum remains weak at this point. Market longs should remain cautious due to the current weakness in buying pressure.

Supramax Q4 V Cal 18

Daily Support – 225, 90, (-40)

Resistance- 593, 715, 920

The recent pullback has resulted in the spread closing below its moving averages, but it remains above the previous low of USD 225, keeping it in bullish territory.

The stochastic is oversold and showing a bullish cross, however it remains below the 30 level, suggesting momentum remains weak at this point. Market longs should remain cautious due to the severity of the recent pullback as this highlights the current weakness we are seeing in the stochastic.

If price action can get above the moving averages with a stochastic above 30, it would suggest buying pressure is gaining in momentum. Technically bullish due to holding above its support, there remains some weakness in the spread at this point, and needs to do more to convince market buyers.